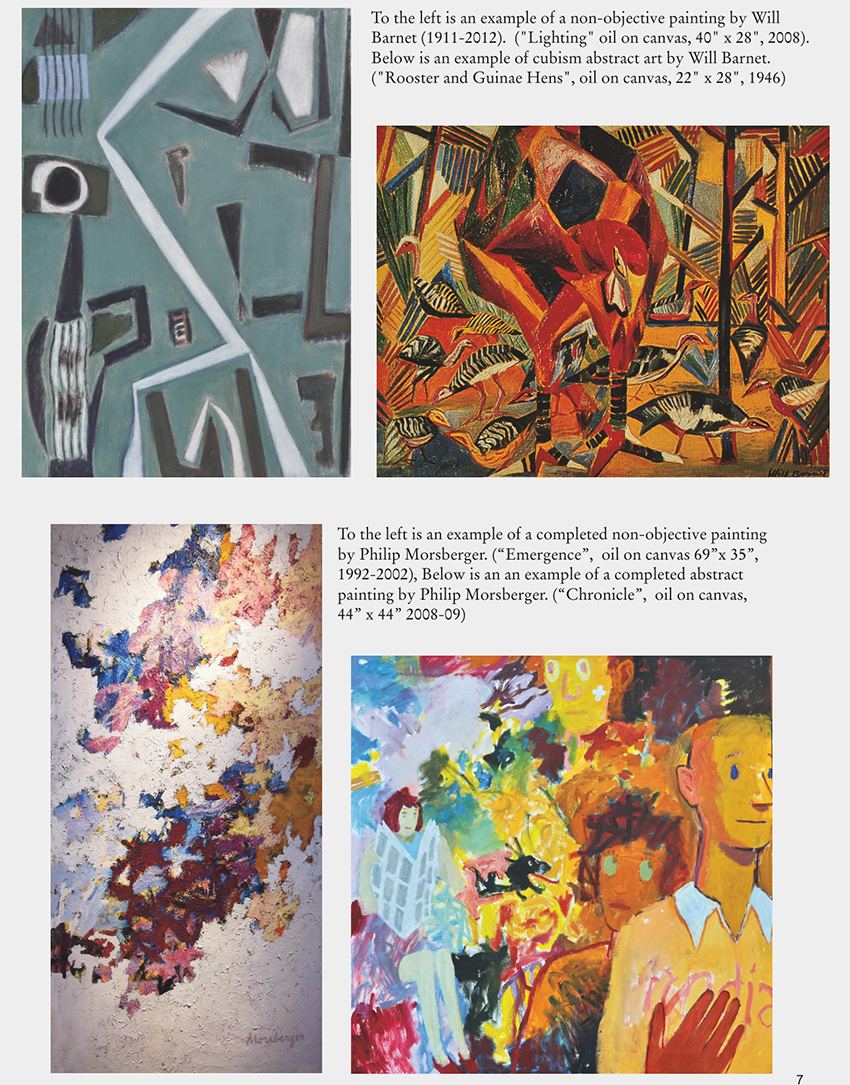

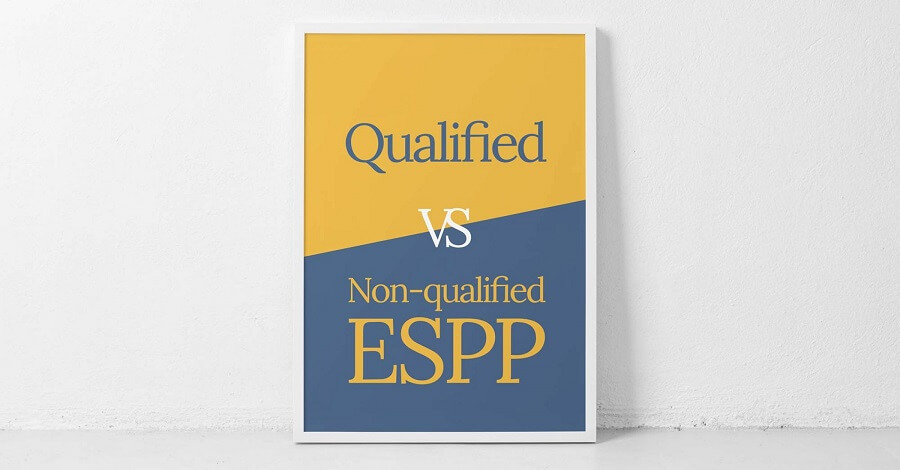

Qualified Vs Non-Qualified ESPPs

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

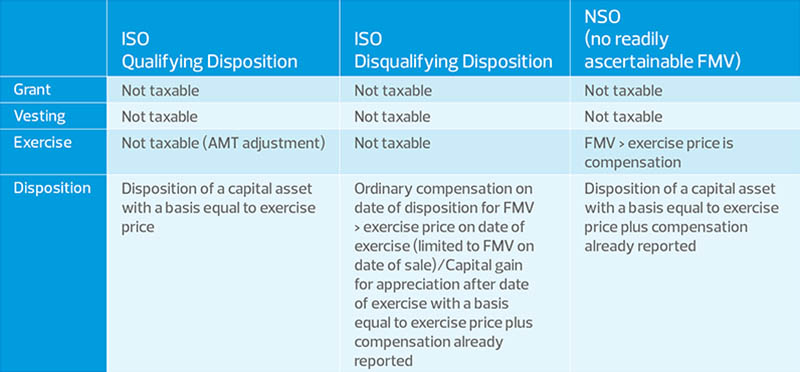

Frequently asked questions about stock options and tax implications

ESPP Disqualifying Dispositions Explained — EquityFTW

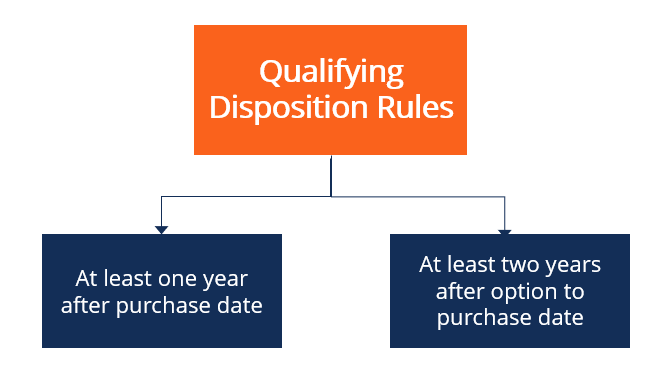

Qualifying Disposition - Overview and How It Affects Your Taxes

ESPPs: A Long Term Investment Strategy for Financial Growth - FasterCapital

The Risks Of Waiting Too Long To Purchase Espp Stock - FasterCapital

Introduction To Espps And Qualified Dispositions - FasterCapital

Introduction to Employee Stock Purchase Plans – ESPP

Qualified Espp - FasterCapital

Espp Stock Purchase Dates - FasterCapital

Qualified Vs Non-Qualified ESPPs

Tax, Accounting and Startups — Tax Treatment of ESPP

ESPPs: A Long Term Investment Strategy for Financial Growth - FasterCapital

Detailed Breakdown of an ESPP Qualifying Disposition — EquityFTW

2018 Employee Stock Purchase Plans Survey

Introduction To Espps And Qualified Dispositions - FasterCapital